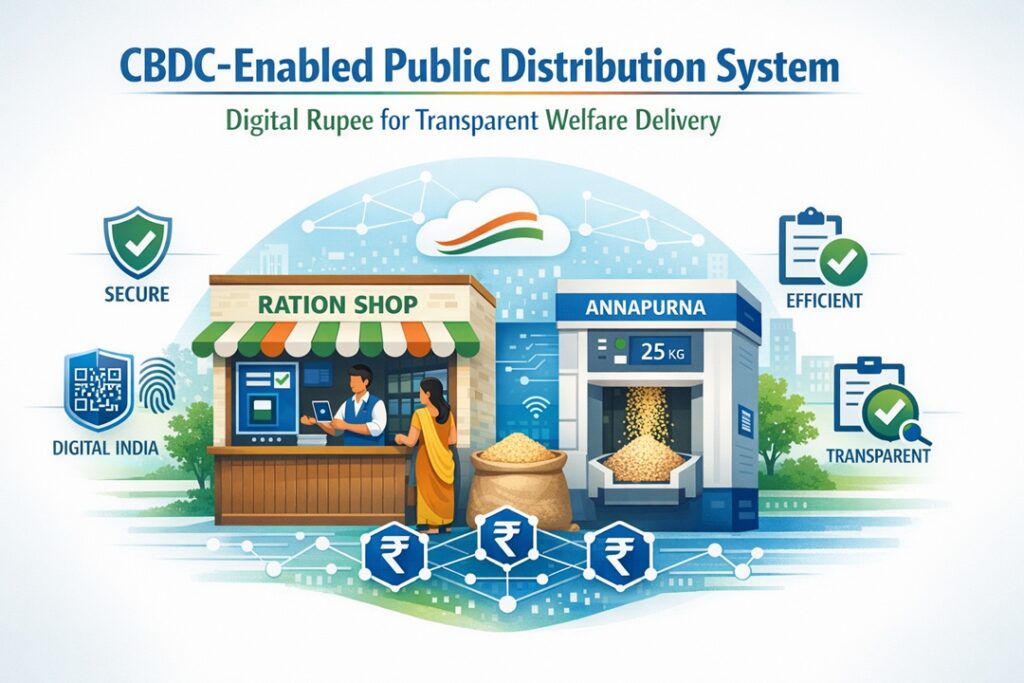

CBDC-Enabled Public Distribution System: A New Digital Welfare Model

Context

The Union Home Minister inaugurated India’s first Central Bank Digital Currency (CBDC)–enabled Public Distribution System (PDS) in Gandhinagar, Gujarat.

Concept Overview

The initiative introduces a digitally secured ration delivery framework by embedding the Digital Rupee into the Public Distribution System, ensuring transparent and tamper-resistant distribution of food subsidies.

Stakeholding Agencies

Ministry of Consumer Affairs, Food and Public Distribution – responsible for policy formulation and execution of PDS reforms; Reserve Bank of India – issuer and regulator of the Digital Rupee.

Policy Objectives

To curb leakages and diversion of food grains; to modernise welfare delivery in line with governance reforms; and to ensure secure, timely access to subsidised essentials for eligible beneficiaries.

Operational Highlights

Pilot Location: Launched in Gandhinagar, Gujarat; Digital Governance Linkage: Integrated with the Digital India ecosystem; CBDC-Based Settlement: Ration transactions conducted using Digital Rupee; Automated Distribution: Annapurna vending machine dispenses 25 kg of food grains in around 35 seconds; Accountability: Digitisation strengthens traceability and beneficiary protection; Future Expansion: Nationwide phased rollout planned over the next 3–4 years.

Why It Matters

Governance Reform: Promotes technology-driven welfare delivery; Scale: Enhances service delivery for nearly 80 crore PDS beneficiaries; Fiscal Efficiency: Reduces subsidy leakages; Public Confidence: Improves trust in welfare administration.

Source : PIB