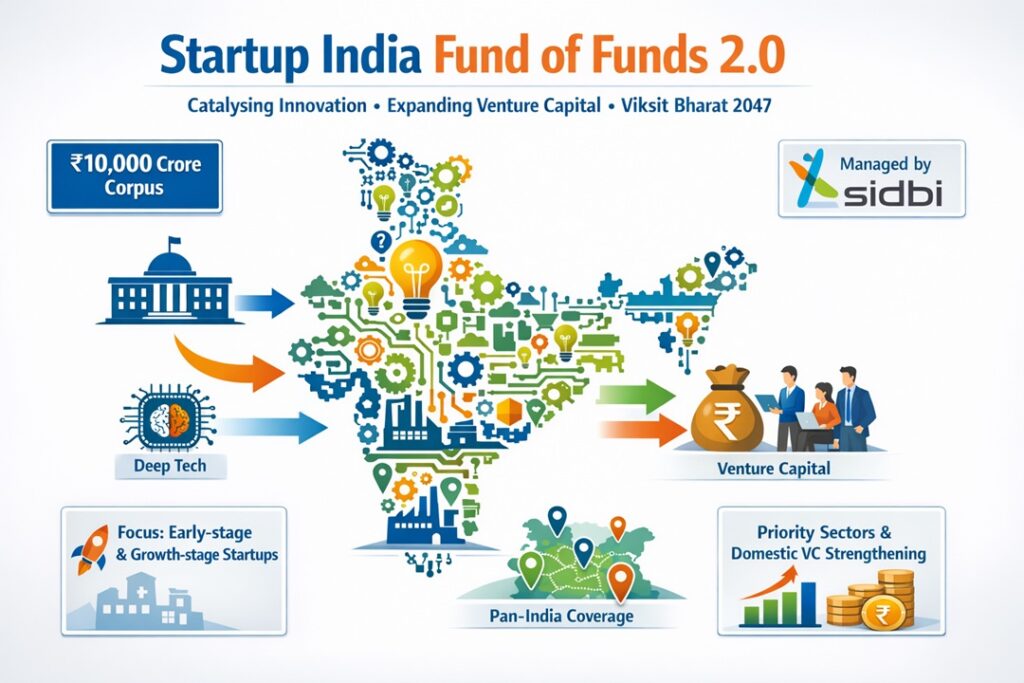

Startup India Fund of Funds 2.0: Key Policy Push for Startups

Context

The Union Cabinet has approved the Startup India Fund of Funds (FoF) 2.0, with a corpus of ₹10,000 crore, aimed at enhancing venture capital availability and strengthening India’s startup financing framework.

Startup India: Policy Framework

- Institutional Background: Startup India is a flagship policy initiative of the Ministry of Commerce and Industry.

- Initiation Year: 2016

- Administrative Body: Department for Promotion of Industry and Internal Trade (DPIIT).

- Policy Rationale: To address credit constraints faced by startups and create a supportive entrepreneurial environment.

- Strategic Outcomes:

- Promote innovation and enterprise formation

- Facilitate startup scaling through institutional support

- Generate employment opportunities

- Foster sustained economic growth

- Encourage a shift towards a job-provider economy

- Annual Observance: 16 January is observed as National Startup Day.

Fund of Funds Model: First Phase

- Scheme Design: Implemented by DPIIT under the Startup India Action Plan.

- Fund Management: Small Industries Development Bank of India (SIDBI).

- Approved Corpus: ₹10,000 crore.

- Investment Strategy: Channelising funds through SEBI-registered Alternative Investment Funds (AIFs) to expand domestic risk capital.

- Performance Snapshot:

- Commitments extended to 145 AIFs

- Investments exceeding ₹25,500 crore

- Support provided to more than 1,370 startups

- Ecosystem Impact:

- Crowded in private capital

- Supported first-generation entrepreneurs

- Strengthened India’s venture capital landscape

Fund of Funds Model: Second Phase

- Policy Context: Introduced to build on the achievements of the first phase.

- Development Focus: Scaling innovation-driven and technology-intensive startups.

- Distinctive Elements:

- Strategic Sector Orientation: Emphasis on priority sectors, deep-tech, and advanced manufacturing

- Early-Growth Support: Addresses funding gaps during critical growth stages

- Nationwide Outreach: Encourages startup expansion beyond major urban centres

- Capital Indigenisation: Strengthens domestic venture capital funds, particularly emerging AIFs

- National Significance:

- Expected to accelerate innovation-led development

- Promotes balanced regional growth

- Contributes to the vision of Viksit Bharat @2047

Source : PIB